Claims processing has relied heavily on manual intervention for years. However, advancements in emerging technologies like generative artificial intelligence (GenAI) are revealing the inefficiencies and high costs of traditional methods. In fact, 65% of insurers believe technology could combat rising claims costs.

Manual processes for inbound claims-related documents — such as policy information, litigation documents, investigation reports, and supporting evidence — lead to errors and delays that directly impact customer satisfaction and inflate operational costs.

Intelligent document processing (IDP) is changing the game. By leveraging AI, GenAI, and machine learning, IDP can automate data extraction, classification, and analysis, streamlining information retrieval and accelerating decision-making. With its ability to efficiently handle vast volumes of structured and unstructured data, IDP enables insurers to resolve claims faster, minimize errors, and improve outcomes for both insurers and their policyholders.

The Need for Intelligent Document Processing

Insurers must sift through various sources — emails, faxes, vendor integrations — and document types such as policy agreements, settlement documents, and first notice of loss (FNOL) forms. Not only are claims adjusters handling a wide variety and length of documents, but they’re also processing them at an overwhelming scale; individual claims adjusters typically handle thousands of documents each year.

It’s not uncommon for adjusters to fall behind and miss claim milestones or worse yet, critical claim information buried in a 200+ page document. Managing this sheer volume of data is a major challenge. Without centralized, efficient processes, teams can struggle to maintain productivity, accuracy, and cost control, risking claims leakage. To address these pain points, insurers need a transformative solution to manage claim documents; IDP is uniquely suited for this task.

Some key benefits that insurers are seeing after implementing IDP include:

- Reduced loss adjustment expense – Automating manual tasks lets adjusters focus on in-depth claims evaluations and more high-value customer interactions.

- Increased claims accuracy – IDP’s ability to cross-reference data from multiple sources enables it to not onlyidentify inconsistencies in claims documents but also to flag potentially fraudulent claims for further investigation.

- Scalability – The technology’s ability to scale with growing data needs empowers claims organizations to manage increasing document flow without sacrificing quality or efficiency.

- Reduced cycle time – Automated data extraction, classification, and validation streamline claims processing, reducing turnaround times and improving overall claims outcomes.

These benefits highlight how IDP can transform claims workflows, but successfully implementing IDP requires a strategic approach.

How Leading Claims Organizations Implement IDP

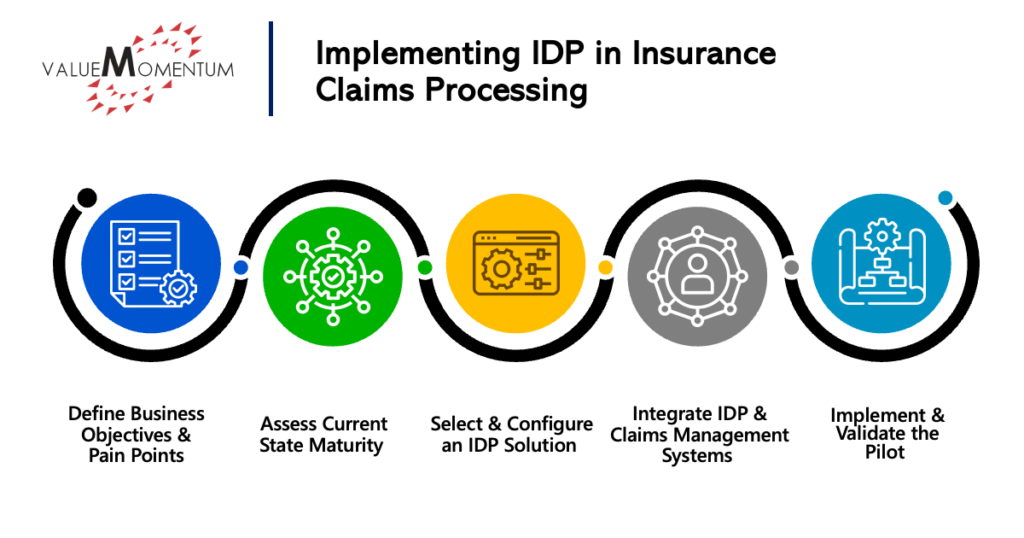

Implementing IDP effectively requires careful planning and execution. By following a structured approach, insurers can unlock the full potential of IDP and achieve greater operational efficiency, claims accuracy, and scalability.

Here are the key steps to take when integrating IDP into the claims process:

Define Business Objectives and Pain Points

Prior to any adjustments to the existing process, insurers should identify what their main challenges are within their claims document processing workflow. Do they have a highly manual workload? Are there specific parts of the process where errors are more common? Where are cycle time delays emerging?

Insurers should assess the impact these challenges are having on their loss adjustment expense (LAE), claims accuracy, and cycle time. Once the specific pain points have been identified, define key performance indicators (KPIs) that can measure improvements IDP brings to these areas. For instance, if manual document processing is a primary pain point, how much has IDP reduced manual efforts? How much more accurate is the process? How much has IDP provided in cost savings?

Assess Current State Maturity

Insurers should closely examine existing document classification, summarization, and indexing systems to identify inefficiencies and gaps where automation could make a meaningful impact. For example, which workflows are manual, and which already incorporate automation? What volume and complexity of documents are being processed? How ready is the workflow to integrate with additional systems?

Understanding the strengths and weaknesses of the current system will help insurance providers determine where IDP can bring the most value. Doing this requires benchmarking against industry best practices to identify automation gaps and generating an IDP maturity score and roadmap for how to improve the workflow.

Select and Configure an IDP Solution

Depending on the organization’s current state and its end goals, different IDP solutions may fit better than others. For insurers who need to focus on converting unstructured data to structured data, optical character recognition (OCR) capabilities will be especially important. Natural language processing (NLP) functionality enables solutions to extract meaningful insights from text, while machine learning and deep learning can help improve accuracy over time and automate document classification and summarization.

In addition, look for solutions that have functionality to support document classification automatically by the type of document it is (e.g., FNOL, legal, medical reports, etc.) as well as the ability to extract key data points from complex claims files and summarize the contents. IDP solutions can also include functionality to help identify anomalies in claims documents and detect fraud as well as automate document routing based on the complexity of a claim to deliver an intelligent workflow.

Integrate IDP and Claims Management Systems

Once the IDP solution has been identified, it’s time to integrate with the rest of the claims management systems in use at the organization. This includes not only claims processing platforms like Guidewire ClaimCenter or Duck Creek Claims, but also enterprise content and customer communication management platforms as well as adjuster and FNOL systems. Insurers should ensure that the IDP system is made compatible with multiple document sources, whether that is via email, fax, or vendor uploads.

In addition to the technical integration, provide clear communication about the benefits of intelligent document processing to those who will be impacted by the technology. Offer training to employees and ensure stakeholders at all levels are prepared for the changes. A successful change management plan helps mitigate resistance, boosts employee confidence, and ensures smooth adoption of the new processes with minimal disruption.

Implement and Validate the Pilot

As with any large technology investment, it’s important to run a proof of concept (PoC) with a small set of claims. This PoC allows insurers to measure the IDP solution’s performance against the KPIs their team identified earlier in the process. Does the solution help reduce document processing time? Does it improve the accuracy of data extraction? Does it reduce the amount of manual intervention required?

Once the baseline functionality has been established, validate the system’s ability to scale across claims of various complexity levels. Only after the PoC phase has been completed satisfactorily should the IDP solution be expanded further into all claims processes.

Once the pilot has been validated and the IDP solution has been applied across the claims workflow, it’s important that insurers establish a feedback loop to refine any AI or machine learning models and implement rigorous compliance checks for data security and regulatory adherence. Continuous monitoring of data quality, efficiency gains, and user feedback will help the organization continue to improve the efficacy of the IDP solution.

One Tier 1 client we worked with, which has a team of 35 employees handling about 900,000 documents a year, experienced a dramatic shift in efficiency after implementing IDP. Before automation, the claims team spent up to three minutes per document on classification alone, totaling around 45,000 person-hours annually. Implementing IDP during a PoC resulted in immediate improvements, setting the stage for the insurer to reap long-term benefits across the board.

The Path to Efficient Claims Processing

IDP is a game changer for insurers looking to streamline their current claims processes. By automating time-consuming manual tasks, improving accuracy, and enabling greater scalability, IDP not only enhances operational efficiency but also helps reduce costs and improve the customer experience.

While the transition to IDP may require thoughtful planning and strategic execution, the long-term benefits far outweigh the investment. By following the steps outlined above, insurers can embark on more efficient, accurate, and cost-effective claims handling, ultimately setting the stage for sustained success in an increasingly competitive market.

Interested in learning more about how to improve the claims process? Check out our case study “U.S. Midwest Insurer Drives Efficiency and Customer Experience with Guidewire ClaimCenter” for valuable insights into how one insurer transformed its claims function to enhance both efficiency and customer satisfaction.